The Of Home Improvement News

Wiki Article

Things about Home Improvement News

Table of ContentsThe Main Principles Of Home Improvement News What Does Home Improvement News Mean?Home Improvement News for DummiesEverything about Home Improvement News

So, by making your house more protected, you can really make a profit. The interior of your house can obtain dated if you do not make modifications and upgrade it from time to time. Interior decoration styles are constantly changing and also what was trendy 5 years ago may look ludicrous now.You could also feel burnt out after checking out the very same setup for years, so some low-budget modifications are constantly welcome to provide you a little bit of modification. You pick to integrate some classic aspects that will certainly remain to seem present and stylish throughout time. Don't stress that these improvements will certainly be pricey.

Pro, Tip Takeaway: If you feel that your residence is as well small, you can redesign your cellar to enhance the amount of room. You can use this as a spare area for your household or you can rent it out to create extra income. You can take advantage of it by working with specialists who offer renovating solutions.

Home Improvement News Can Be Fun For Anyone

Home remodellings can boost the means your house looks, however the advantages are more. When you deal with a trusted remodelling business, they can assist you enhance effectiveness, function, way of life, as well as value. https://soundcloud.com/hom3imprvmnt. Hilma Building in Edmonton offers complete remodelling services. Check out on to discover the benefits of house restorations.

Not only will it look out-of-date, but locations of your house as well as important systems can start to show wear. Regular house upkeep as well as repair work are essential to keep your residential or commercial property value. A residence renovation can assist you maintain and also boost that value. Jobs like exterior remodellings, kitchen restorations, and washroom remodels all have exceptional rois.

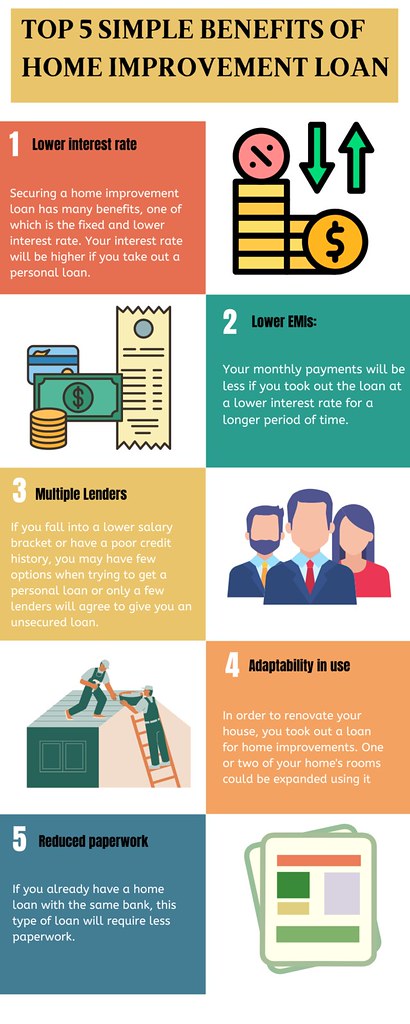

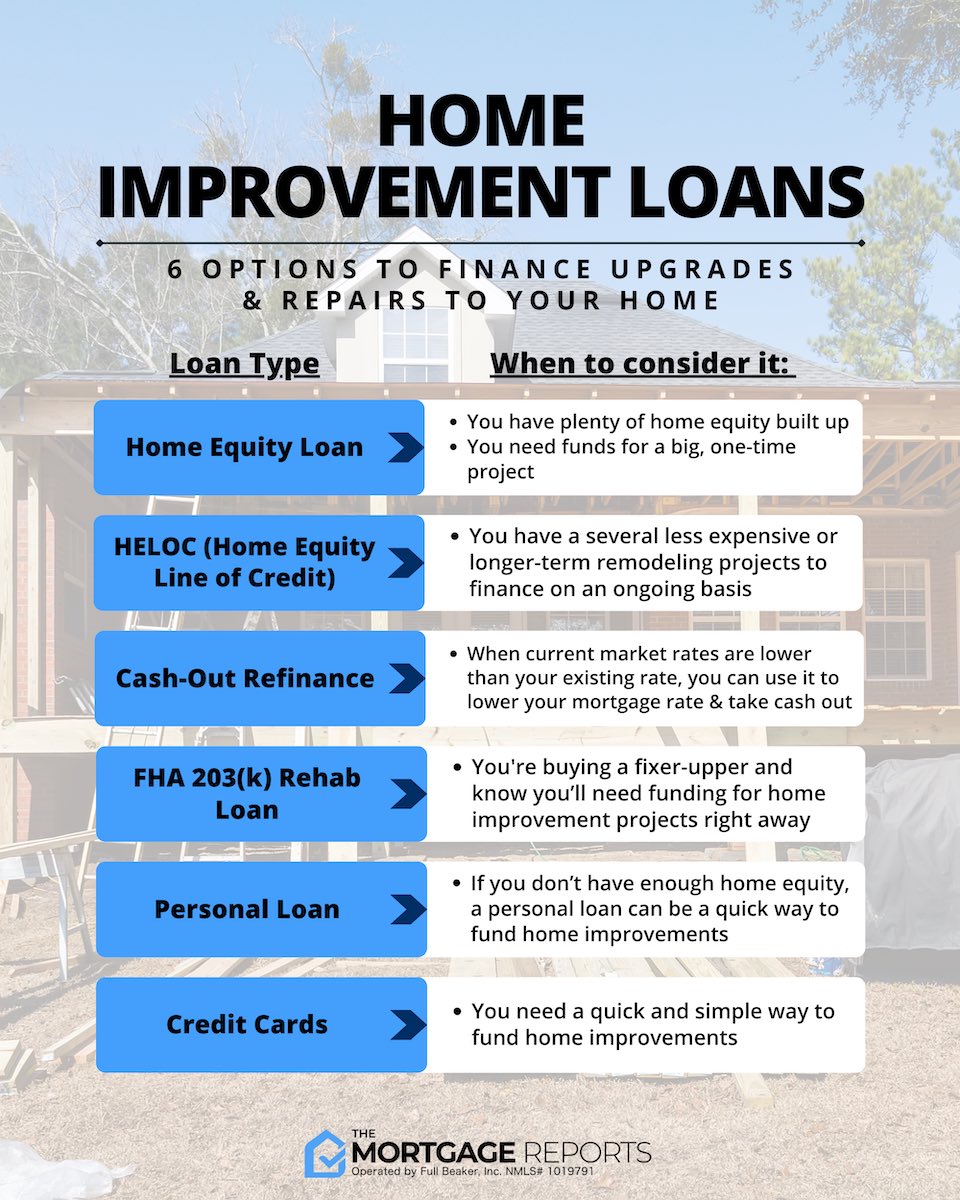

Residence equity fundings are preferred amongst property owners aiming to money improvements at a lower interest price than other financing alternatives. The most usual usages for house equity. https://www.4shared.com/u/8OX1CdJG/wiltonwolfe33101.html funding are home improvement tasks as well as debt loan consolidation. Making use of a house equity lending to make home improvements includes a couple of benefits that uses do not.

Rumored Buzz on Home Improvement News

That fixed rate of interest implies your month-to-month payment will be consistent over the term of your loan. In an increasing rate of interest atmosphere, it may be less complicated to factor a fixed payment right into your spending plan. The various other option when it concerns touching your house's equity is a house equity line of credit history, or HELOC.You'll just pay passion on the cash you've borrowed during the draw period, but, typically at a variable price. That indicates your month-to-month settlement undergoes transform as prices climb. Both residence equity lendings and HELOCs use your house as collateral to secure the funding. If you can not afford your regular monthly repayments, you might lose your home-- this is the most significant danger when obtaining with either type of funding.

Take into consideration not simply what you want right now, however what will certainly appeal to future buyers since the projects you pick will certainly affect the resale value of your residence. Collaborate with an accounting professional to see to it your passion is appropriately deducted from your tax obligations, as it can save you tens of hundreds of dollars over the life of the funding (property maintenance).

Getting The Home Improvement News To Work

Residence equity finances have low rate of interest compared to various other kinds of financings such as individual financings and also charge card. Current house equity prices are as high as 8. 00%, but individual financings are at 10. 81%, according to CNET's sis website Bankrate. With a home equity lending, your rates of interest will be dealt with, so you don't have to worry regarding it rising in a rising rate of interest atmosphere, such as the one we're in today.Also as mentioned above, it matters what sort of restoration jobs you carry out, as particular residence renovations offer a higher return on investment than others. For example, a small kitchen area remodel will certainly redeem 86% of its value when you sell a residence compared with 52% for a timber deck enhancement, next page according to 2023 information from Renovating publication that examines the expense of renovating projects.

While residential property worths have increased over the last 2 years, if home prices drop for any kind of reason in your area, your financial investment in enhancements won't have actually increased your house's value. When you wind up owing extra on your home mortgage than what your house is really worth, it's called unfavorable equity or being "underwater" on your home mortgage.

A HELOC is frequently much better when you desire extra versatility with your finance. With a fixed-interest rate you do not need to fret about your repayments going up or paying a lot more in passion in time. Your month-to-month payment will certainly constantly coincide, whatever's occurring in the economy. Every one of the money from the lending is distributed to you upfront in one settlement, so you have access to every one of your funds right away.

Report this wiki page